一篇电讯新闻还宣称,“美联储量化宽松将导致本次大通胀”。

作者:ChenZhao

来源:经济机器(ID:EconomicMachine)

The recent WSJ article by James Mackintosh1 “Everything Screams Inflation”, breathlessly tells the financial world that we are at a “generational turning point” and “investors are woefully unprepared”. A Telegraph article also declared that “The Fed QE Will Cause Inflation This Time”. All of this echoes an avalanche of media and advisory reports in recent months calling for much higher inflation ahead.

最近詹姆斯·麦金托什在《华尔街日报》发表文章“一切都在惊呼通胀来了”,他上气不接下气的告诉金融界,我们正处在“大时代转折点”,“投资者们完全没有准备”。一篇电讯新闻还宣称,“美联储量化宽松将导致本次大通胀”。所有这些都与最近几个月媒体和策略报告的大量涌现相呼应,市场中充斥着未来通胀将大幅上升的声音。

Alpine Macro has been trying to address this fear in quite a few research reports. I would like to take a look at the 1970s inflation experience, which no doubt is the “generational turning point” referred to by the WSJ. I remember that episode well, having worked at the Bank of Canada in the 1960s, when the groundwork for the 1970s inflation was laid.

Alpine Macro在很多研究报告中呼吁这种担忧过分了。我们一起看看20世纪70年代的通胀经历,当年所发生的事情无疑是《华尔街日报》提到的“大时代转折点”。我相当清楚地记得那一幕,1960年代我曾在加拿大银行工作,当时的情况为1970年代的大通胀打下了基础。

01

My Brief U.K. Stint In The 1970s

20世纪70年代,我短暂的英国任期

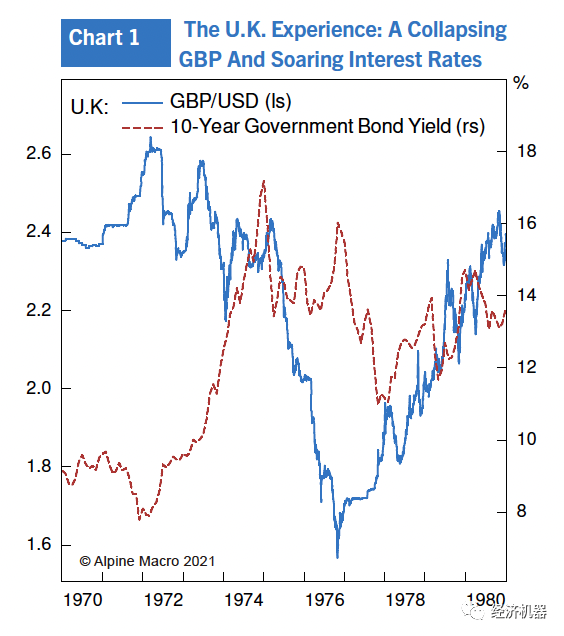

In the early to mid-1970s, when inflation began to soar, I was living in London, having moved the then-small BCA there for a while, to get a ring-side seat to observe what a real inflation looks like. As it turned out, the 1970s saw the greatest peace time inflation. I was not disappointed with the learning experience: The U.K. stock market halved and then halved again; my floating rate mortgage on 100% of my new home moved in six months from 8% to 18%. Sterling collapsed (Chart 1), gold was soaring, coal miners went on strike, reducing power supplies and forcing the economy onto a three-day week. Out-of-work Cockney traders in the city started calling an over-the-counter market in toilet paper!

上世纪70年代初到中期,当通胀开始飙升时,我住在伦敦,把当时规模还很小的BCA搬到那里运营了一段时间,作为一个旁观者,观察真实的通胀情况。事实证明,20世纪70年代出现了和平时期最大规模的通胀。我对这段经历印象深刻:英国股市下跌了一半,然后又除以二;我新房子的抵押贷款浮动利率在六个月内从8%提高到了18%。英镑暴跌(图1),黄金飙升,煤矿工人罢工,电力供应减少,迫使经济一周只能运行三天。城里失业的伦敦交易员开始在场外交易柜台叫卖卫生纸!

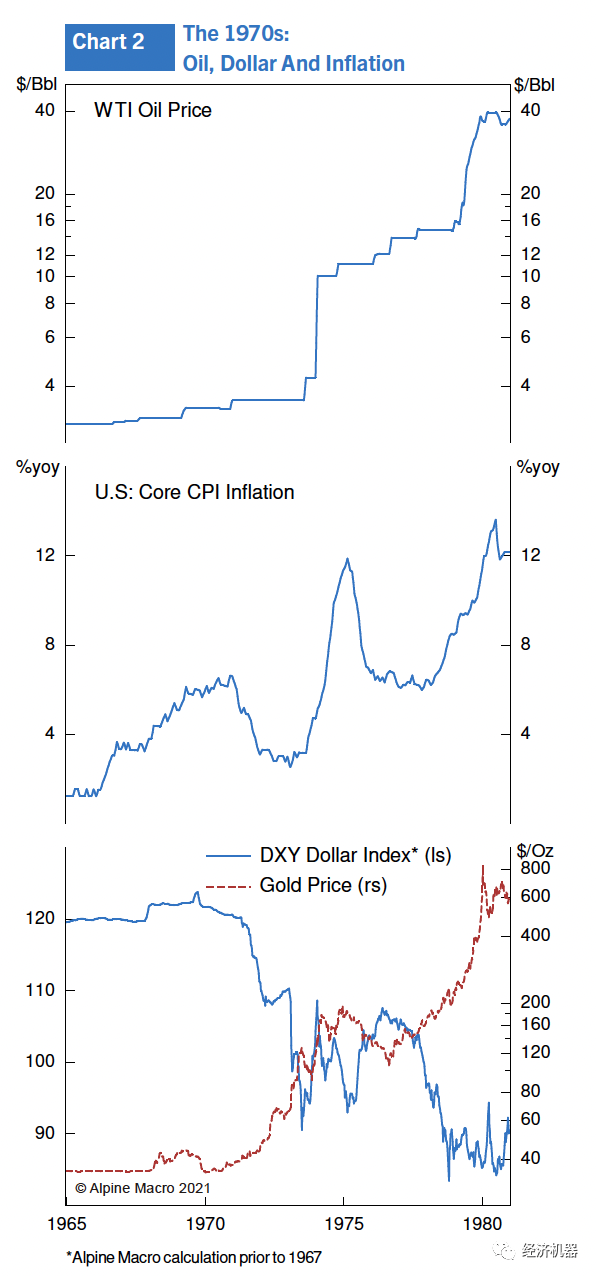

It was already getting scary but when the OPEC oil embargo ran the oil price up in its first of two big moves from $4 to about $10/bbl (Chart 2), it created a huge shortage of gasoline, diesel and jet fuel, and reinforced the already severe shortage of energy from the coal miners strike. Conditions went from being scary to frightening. The oil price later had a second big move to $40/bbl, a 10 bagger for OPEC and a disaster for oil consuming countries.

事情已经变得很可怕了,但就在这时,石油禁运令油价从4美元/桶上涨至10美元/桶(图2),造成了汽油、柴油和航空燃料的严重短缺,并加剧了因煤矿工人罢工造成的能源严重短缺。情况从可怕到恐慌。油价后来又出现了第二次大的波动,冲到40美元/桶,欧佩克的天堂,石油消费国的灾难。

02

America’s Inflation Problem Back Then

当年美国的通胀大麻烦

From 1965 to 1980, U.S. price inflation moved in three major waves from below 2% to a peak of over 14% in 1980 (Chart 2, middle panel). It is important to note that the 1970s inflation was not a surprise. It had reached over 6% in the late 1960s before pulling back after the brief 1970-71 recession. The reason for that 1965-1970 surge was that President Johnson, in the second half of the 1960s, pursued a “guns and butter” policy – fighting an escalating war in Vietnam and another domestic one on poverty, racism and inequality. That was labelled the “Great Society” program and rivalled Roosevelt’s “New Deal” of the 1930s.

从1965年到1980年,美国物价通胀经历了三次大的波动,从低于2% 的水平上升到1980年超过14%的峰值(图2,中间部分)。值得注意的是,上世纪70年代的通货膨胀并不意外。在1970-1971年短暂的经济衰退后之前,它在20世纪60年代末就已经达到了6%以上。1965-1970年的激增是因为约翰逊总统在1960年代后半期推行了“大炮加黄油”的政策——在越南战争的同时,国内打响了另一场关于贫困、种族主义和对抗不平等的战争。这被称为“伟大社会计划”,其规模与影响力与罗斯福1930年代的“新政”不相上下。

The problem was that there was no slack in the economy. In fact, the economy was running on average about 2% above capacity. There was a brief respite during the shallow and brief 1970-71 recession but then the economy roared back and moved 4% above capacity. Inflationary pressures started building rapidly again, having been cooled only temporarily. Under the surface, inflationary pressure was very much alive and well.

问题是经济没有萧条。事实上,经济运行水平比平均产能高出约2%。在1970-1971年短暂的经济衰退中曾有过暂时的疲软,但随后经济复苏,超过产能4%。暂时降温后,通胀压力又开始迅速积聚。从表面上看,通胀压力非常大。

The breakdown of the Bretton Woods System in March 1971 was another major structural reason behind high and rising inflation in the 1970s. Since the end of the WWII, the U.S. was on a quasi-gold standard.3 However, the gold standard was misunderstood. It was frequently a fair-weather standard. If a country does not follow the rules because it doesn’t like the discipline imposed, it loses its primary function of maintaining price stability.

1971年3月布雷顿森林体系的崩溃是1970年代通胀率居高不下并不断上升的另一个主要结构性原因。自二战结束以来,美国一直采用准金本位制。3然而,金本位制被误读了,这常常是一切风平浪静下标准。如果一个国家不遵守规则仅仅因为它不喜欢被纪律约束,那么它将失去了维持价格稳定的主要功能。

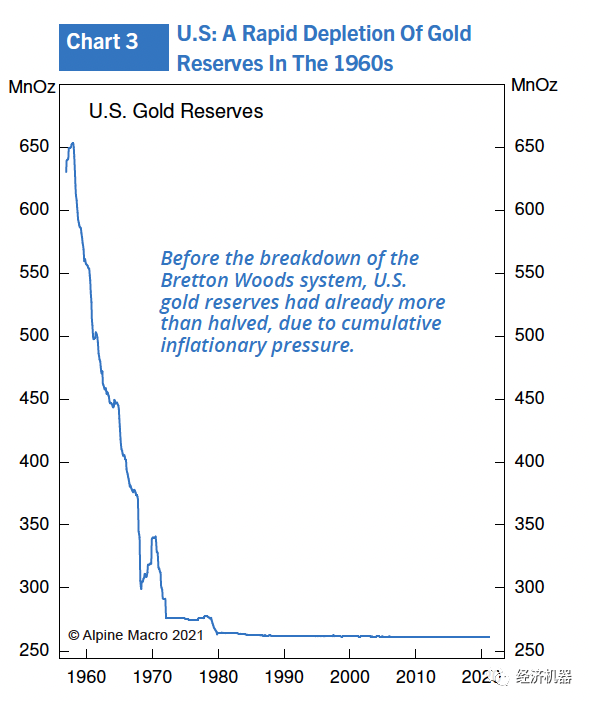

Chart 3 shows U.S. gold reserves from 1960 forward. The early stage of the decline in gold reserves reflected a post-war rebalancing of central bank gold reserves but after 1965 when inflationary pressure accelerated, the decline in the gold stock steepened, interrupted only briefly during the 1970-71 recession. This was the classic warning signal from the gold standard: time to tighten monetary policy. By August 1971, the U.S. had to make a decision – deflate to maintain the gold/ dollar link or let the dollar float and escape from the discipline. With the major shift to the left in politics and high unemployment, there was no appetite to deflate. President Nixon opted for delinking the dollar from gold.

图3显示了1960年以后美国的黄金储备。黄金储备下降的早期阶段反映了战后中央银行黄金储备的再平衡,但在1965年通胀压力加速后,黄金库存的下降急剧恶化,仅在1970-1971年经济衰退期间短暂缓解。这是金本位发出的经典警报信号:是时候收紧货币政策了。到了1971年8月,美国不得不做出一个决定——紧缩以维持黄金与美元的联系,或者让美元浮动以摆脱这种约束。随着政治上的重大左倾和高失业率,当局对紧缩没有兴趣。尼克松总统选择将美元与黄金脱钩。

The dollar price of gold moved rapidly from $35/oz to $180/oz and the trade-weighted dollar fell in its first phase by about 10%. Inflation soared as prices for anything that was priced off the dollar took off.

黄金美元价格从35美元/盎司迅速升至180美元/盎司,贸易加权美元在第一阶段下跌了约10%。通货膨胀沿着任何以美元计价东西的价格上涨。

As I mentioned earlier, oil prices more than doubled in 1970 and more than doubled again in the late 1970s. The U.S. economy was much more oriented toward manufacturing than today so surging crude prices shook the economy very badly. That was when the term “stagflation” was coined, describing a stagnating economy but with high inflation.

正如前面提到的,油价在1970年翻了一倍多,在1970年代末又涨了一倍多。当时的美国经济比今天更倾向于制造业,因此原油价格飙升严重冲击了美国经济。当时“滞胀”一词被创造出来,用来形容经济停滞但通货膨胀率却居高不下。

The Fed was terrified to let this relative price shock get absorbed by the real economy, so they mone-tized it through much of the 1970s, causing the U.S. dollar to decline much further, both against gold and on a trade-weighted basis. The inflationary surge ended in 1981 with Paul Volcker’s “cold bath” policy which included 20% interest rates at the peak.

当年美联储害怕让这种相对价格冲击被实体经济吸收,因此他们在20世纪70年代的大部分时间里将其货币化,导致美元兑黄金和贸易加权汇率的进一步下跌。1981年,随着保罗沃尔克(paulvolcker)推行的“冷水浴”(cold bath)政策,通胀率飙升结束,20% 的利率水平也见顶回落。

03

Where Monetarists Have Been Wrong

货币主义者错在哪里

A major lesson for me from that experience in 1973-74, and the rest of the decade back home later, was to make me hyper-sensitive to inflation and it took me a long time to stop seeing another major inflation outbreak every time the Fed became expansionary, and the Treasury ran bigger deficits. The reality was that, after Paul Volcker gave the economy a cold bath in 1981 and President Ronald Reagan focused on the supply side of the economy in the 1980s, price inflation has been on an irregular path downwards from the 14% peak in 1980 to the (temporary) near-zero reached in April 2020.

这个十年剩下的时间里我回到了国内,1973-1974年的经历给我上了重要的一课,那就是让我对通胀非常敏感,每次美联储扩张,财政部赤字增加,我都花了很长时间仔细思考另一场大的通胀是否会爆发。现实情况是,在1981年保罗·沃尔克(Paul Volcker)给经济洗了个冷水澡,上世纪80年代罗纳德·里根(Ronald Reagan)把重点放在经济的供给方面之后,通胀率就一直在不规则地从1980年14% 的峰值下降到2020年4月(暂时的)接近零的水平。

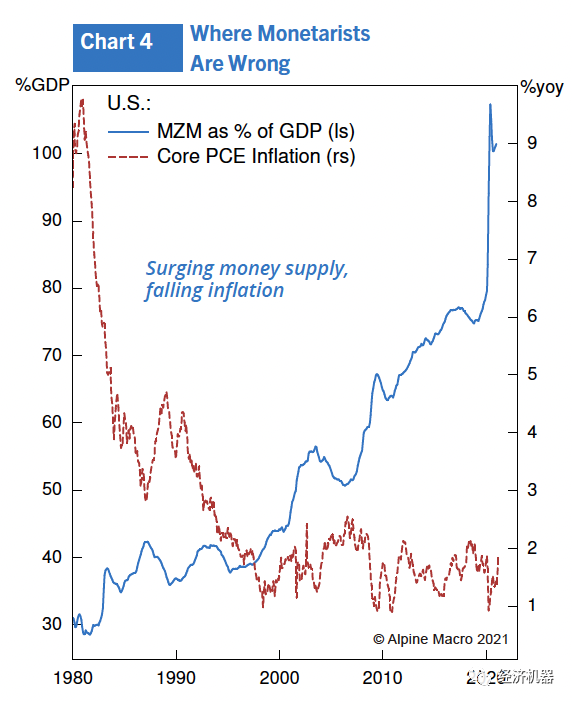

During much of the 1980s, the money supply (MZM) rose strongly (Chart 4). Milton Friedman’s monetarist model was still in vogue. Inflation fears remained endemic throughout the 1980s. However, the model was deeply flawed because the velocity of money has come down steadily since Volcker’s time, absorbing much of the growth in money supply.

在20世纪80年代的大部分时间里,货币供应量(MZM)强劲增长(图4)。米尔顿·弗里德曼的货币主义思想仍然很流行。在整个1980年代,对通胀的担忧仍然普遍存在。然而,该模型存在严重缺陷,因为自沃尔克时代以来,货币流通速度稳步下降,吸收了大部分货币供应的增长。

This is a lesson for all forecasters who rigidly adhere to an outmoded theory. Like everything in economics, you have to look at both demand and supply. In the 1980s, the demand for money soared, a phenomenon then called “monetary re-entry.” Only later on did people realize that velocity of money is simply a function of interest rates and has, therefore, collapsed along with falling price inflation. A slowing velocity has absorbed much money creation, preventing price inflation from sustainably rising. That should be remembered in the context of today’s inflation fears.

这是所有严格坚持过时理论投资人的一个重大教训。就像经济学中大家学到的,你必须同时考虑需求和供给。上世纪80年代,货币需求猛增,一种后来被称为“货币再注入”的现象,直到后来人们才意识到货币速度只是利率的函数,因此,随着物价通胀的下降,货币的流通速度已经崩溃。速度放缓吸收了大量的货币创造,防止物价通胀持续上升。在今天的通胀恐惧中,特别应该牢记这一点。

04

Key Takeaways

关键点

Most people’s mental framework goes back only as far as their own memories and experience and creates a subconscious bias. The 1960-80 period was structurally totally different from today’s. Very few investors, economists, journalists and policy makers today were working then. Some salient differences between then and now are worth noting.

大多数人的认知只能追溯到他们自己经历过的历史,并造成潜意识的偏见。1960-1980年代的经济在结构上与今天完全不同。很少有当时的投资者、经济学家、记者和决策者今天仍在工作。因此,当时和现在的一些显著差异值得注意。

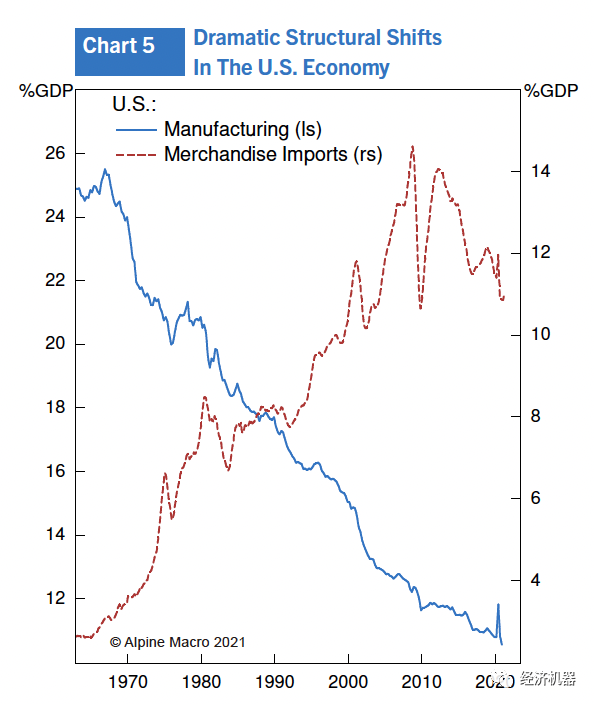

(1) The U.S. was essentially a closed economy in the 1970s. Imports were about 3.5% of GDP. They are now almost four times larger relative to GDP (Chart 5). Imports are a big safety valve; when shortages arise and prices rise, imports increase to take the steam off. That doesn’t happen easily in a closed economy. In addition, there has been a relative abundance of excess savings in the rest of the world. This means that the U.S. can easily import much cheaper foreign savings to make up any shortfall in domestic savings, should the economy run too hot.

(1) 20世纪70年代,美国基本上是一个封闭的经济体。进口仅占国内生产总值的3.5%。而现在几乎是当时的四倍(图5)。进口是压力释放安全阀;当出现短缺和价格上涨时,增加进口以缓解压力。在一个封闭的经济体中,这种情况就很难办。此外,世界其他地区的超额储蓄也相对充裕。这意味着,如果经济过热,美国可以很方便地进口更便宜的外国储蓄,以弥补国内储蓄的任何缺口。

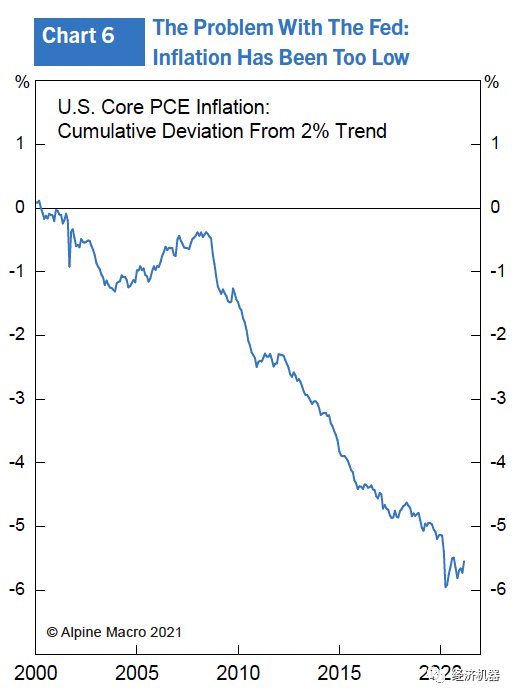

(2) Manufacturing then was almost a quarter of the economy; it is 10% now. The world currently is well into the “Fourth Industrial Revolution”, dominated by both technology producers and users, and a perfect storm of technological innovation is occurring and will accelerate in the years ahead. The rapid digitization of the world economy, robotic technology, AI and 5G communication are inherently deflationary which goes a long way towards explaining why the Fed has not been able to get inflation up to its target for more than a decade (Chart 6).

(2) 当时制造业几乎占美国经济的四分之一;现在仅为10%。当前,世界正进入由技术提供方和使用方共同主导的“第四次工业革命”,一场完美的技术创新风暴正在形成,并将在未来几年加速。世界经济的快速数字化、机器人技术、人工智能和5G通信本质上是导向通缩的,这在很大程度上解释了美联储为什么十多年来未能将通胀率提高到目标水平的原因(图6)。

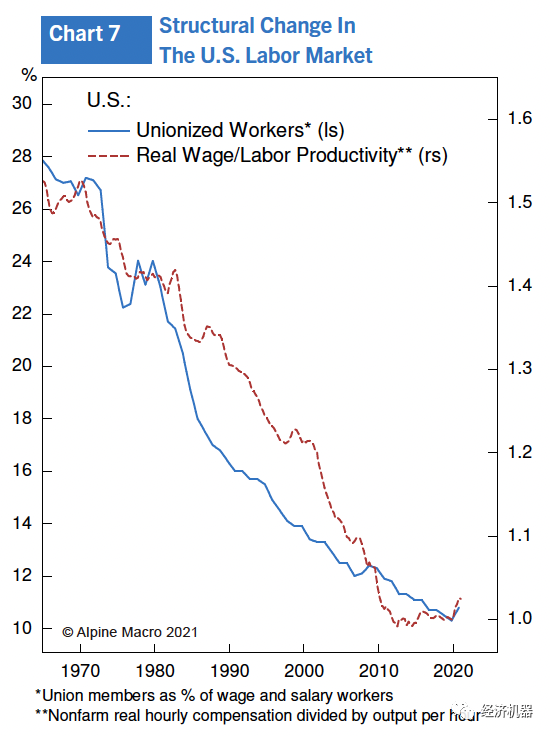

(3) Unionized workers then were 25% of the labor force, now they are about 10%. Labor unions introduce wage rigidity, while reducing labor productivity (Chart 7). In the 1970s and 1980s, wage rigidity was a key reason causing wage-price spiral. Most workers in the U.S. today not only have to compete for jobs among themselves, but also, directly or indirectly, have to compete with workers in low-wage countries as a result of globalization. It is very hard for the average wage rate to sustainably exceed labor productivity.

(3) 当时加入工会的工人数量占劳动力的25%,现在约占10%。工会引入刚性工资,同时降低劳动生产率(图7)。在70年代和80年代,刚性工资是导致劳动力价格螺旋上升的一个关键原因。今天,美国的大多数工人不仅要相互竞争工作,而且由于全球化的影响,还必须直接或间接地与低工资国家的工人竞争。平均工资率很难持续超过劳动生产率的水平。

The burning question today is whether another major inflationary surge could happen again? My take is that it is possible but very unlikely. Slack in the economy is still substantial, estimated at roughly 2.3% of GDP, in contrast to significant excess demand for much of the 1960s and 1970s.

今天最紧迫的问题是,是否会再次出现一次严重的通胀飙升?我认为这是可能的,但可能性很小。与上世纪60年代和70年代大部分时间的大量过剩需求形成对比的是,今天经济疲软程度仍然很大,估计约占GDP的2.3%。

Some would argue that the Fed’s monetization during the two oil shocks in the 1970s greatly exacerbated the inflation outbreak and the Fed is monetizing fiscal deficits today. What’s the difference? In my view, the comparison is not entirely correct: Back in the 1970s, the U.S. economy was running above potential, so the Fed eased into a booming economy with no spare capacity. Since 2020, however, the Fed has been easing aggressively on a collapsing economy with unemployment shooting up to 15%. Even today, the U.S. still has 8 million people out of a job. Of course, if the Fed continues this policy long after the economy has fully recovered, that would be inflationary, but it is too early to make that judgment at the moment.

有人会说,美联储在上世纪70年代两次石油危机期间的货币化大大加剧了通胀的爆发,美联储如今正在将财政赤字货币化。这有什么区别呢?在我看来,这种比较并不完全正确:早在上世纪70年代,美国经济就已经超出了潜力,因此美联储很轻松的得到了一个没有多余产能的蓬勃经济体。然而,自2020年以来,随着失业率飙升至15%,美联储一直在对崩溃的经济采取积极的宽松政策。即使在今天,美国仍有800万人失业。当然,如果美联储在经济完全复苏很久之后继续实施宽松政策,那就是通胀,但目前做出这一判断还为时过早。

How about fiscal stimulus? A lot of the fiscal thrust with current policy is in the form of transfer payments and has nothing like the demand impact of government expenditure in goods and services via investment. In addition, these transfer payments will reverse in good part in the year ahead. President Biden's infrastructure proposals will get scaled back as will the tax hike proposals. It is hard to believe that the Fed would remain aggressively expansionary once inflation is moving back to where they are aiming.

财政刺激有啥后果?现行政策中的许多财政推动力是以转移支付的形式出现的,与政府通过投资在商品和服务方面的支出对需求的影响完全不同。此外,这些转移支付在未来一年将在很大程度上逆转变成拖累。拜登总统提出的基础设施建设方案和增税方案都将被缩减。很难相信,一旦通胀回到他们的目标,美联储会继续积极扩张。

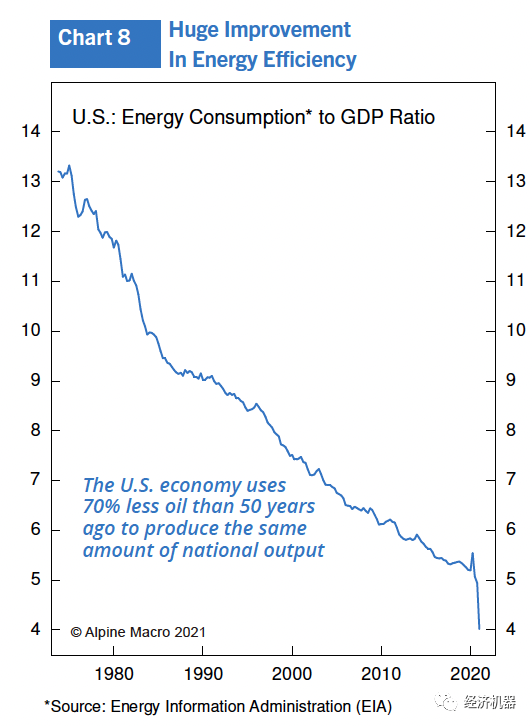

With the dramatic reduction in the U.S. economy's oil intensity (Chart 8), there cannot be a major oil shock like the 1970s. If anything, the oil price is likely to reinforce deflationary pressures as the decarbonization of the economy proceeds and technology continues to reduce the cost of green alternatives. The mania in anything green means that access to capital is seemingly unlimited and this has to increase the supply of energy alternatives.

随着美国经济石油需求密集度的急剧下降(图8),不可能出现上世纪70年代那样的重大石油冲击。如果非要说有什么影响的话,随着经济的脱碳进程和科技不断降低绿色替能源的成本,油价可能会承受更大的通缩压力。任何绿色能源的狂热都意味着该行业获得资本的途径似乎是无限的,这业必将增加替代能源的供应。

2026年1月24日杭州,诚邀您拨冗莅临。

拿包+尽调+处置+法拍+精华案例全解析!

做好不良资产,学这一门课就够了!

2位深耕该领域的大咖老师领衔主讲,用特殊机会投资视角拆解困境上市公司重组重整中的巨大机遇。

投资交易/买包-运营管理-处置/分散诉讼/分散执行/调解全流程

全面掌握最新结构化融资技能!

还没有评论,赶快来抢沙发吧~